(NEXSTAR) From the slip of 2021, individuals Service Loan Forgiveness System try overhauled by Biden management. Ever since then, tens of thousands of consumers have obtained $8.step 1 million inside the beginner credit card debt relief.

The general public Provider Mortgage Forgiveness system, otherwise PSLF, was developed when you look at the 2007 towards the goal of helping teams having nonprofit and you may bodies agencies from the forgiving its student education loans once 10 many years of money (120 overall money). The general acceptance rate among applicants has been lower loan unemployed just one in 5 of the step one.3 million individuals desire debt release owing to PSLF was basically on track observe rescue by 2026, centered on research throughout the Washington Blog post.

During the 2021, the fresh U.S. Agency out of Studies announced a big difference one temporarily waives particular PSLF conditions to give individuals borrowing from the bank into the mortgage termination aside from its federal mortgage type or if perhaps that they had already been enrolled in good specific percentage package, when they consolidated the financial obligation till the avoid away from the newest waiver.

Till the waiver, consumers needed seriously to keeps a particular government loan a primary Financing so you’re able to qualify for PSLF. Consumers you may combine the obligations on Lead Loans for PSLF, however, people payments produced to your finance prior to consolidation didn’t amount towards the the necessary tally.

That it waiver is currently set-to expire just after , meaning qualified consumers simply have about four days leftover to make use of. Richard Cordray, your face off Federal Beginner Support, said during the an event the 2009 week one to as he try pressing toward PSLF waiver to get longer, Chairman Biden may do not have the professional authority to help you agree particularly a circulate.

PSLF qualifications

A current declaration on the Pupil Borrower Safety Cardio discover more 9 million public service gurus most likely qualify for obligations termination due to the PSLF program, but i have yet , to document the records to begin with the process. California, Colorado, Florida, and you can Ny feel the really public service workers that have student financing financial obligation, according to SBPC.

As the explained a lot more than, PSLF is meant to give eligible public service teams financial obligation forgiveness just after an appartment number of repayments were created.

- Be applied because of the an excellent You.S. federal, county, regional otherwise tribal bodies or not-for-finances team (government provider comes with You.S. military service)

- Work full-time for that company or business

- Has Direct Financing (or consolidate other government student education loans on a direct Mortgage)

- Generate 120 qualifying repayments

Within the latest PSLF waiver, eligible consumers can also be located credit having money produced into most other mortgage versions, lower than people fee package, before integration or adopting the deadline. Individuals who received Teacher Financing Forgiveness can apply the period of services you to lead to their qualification into the PSLF, if they certify PSLF a position for the period.

Simple tips to determine if your meet the requirements

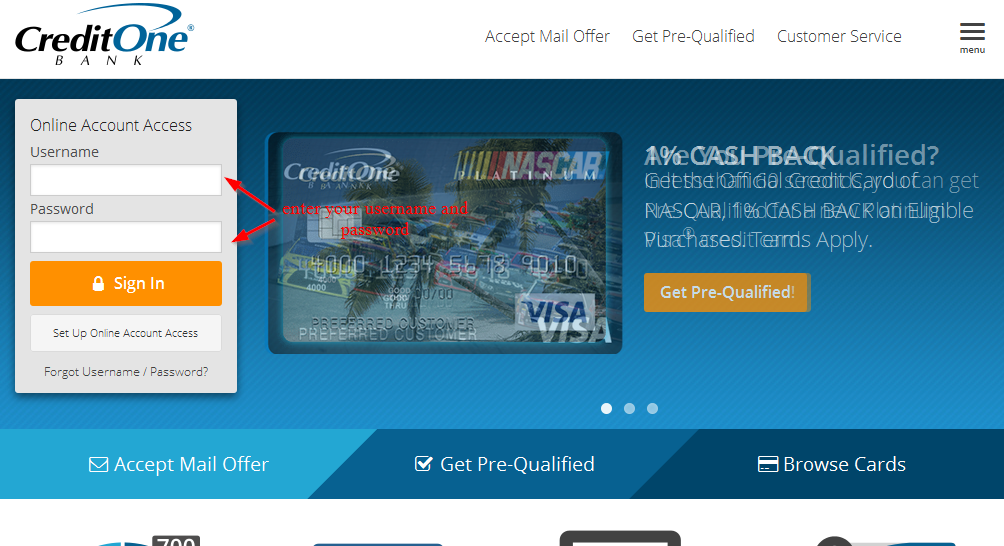

Step one into the determining your own eligibility was going to the FSA’s website and signing in the membership. It is possible to research your employer when you look at the FSA’s database and you can incorporate details about the a career. After you get a hold of your employer, possible determine whether it qualifies around PSLF.

Next, predicated on SBPC’s walkthrough book, you need to determine which form of federal student education loans your possess. Head Finance meet the criteria to own PSLF whenever you are almost every other fund need to getting consolidated on the an immediate Integration Loan. Till the avoid out-of , earlier qualifying costs you’ve made for the a low-Lead Mortgage often matter with the needed 120 money PSLF demands to possess forgiveness.

Once you’ve completed the fresh new procedures more than, you’ll want to prove your own a position. You will want to up coming have the ability to fill out your own PSLF mode.

Which qualifies into the already-accepted student loan forgiveness?

When you find yourself common student loan forgiveness has not yet yet , be realized, some U.S. borrowers have obtained some debt relief. Roughly 1.step 3 mil consumers have observed $twenty six million in the beginner obligations forgiveness since President Biden grabbed workplace.

As well as the lots and lots of borrowers having gotten personal debt termination under the refurbished PSLF program, other 690,one hundred thousand borrowers have obtained a total of $7.nine billion within the student education loans removed courtesy discharges on account of borrower coverage and you can college closures. More than 400,000 individuals have obtained over $8.5 mil in debt forgiveness as a consequence of total and you can long lasting handicap launch.

History month, new Biden government provided to terminate $6 mil during the federal beginner debt to own around two hundred,000 borrowers as part of a proposed category-step settlement. The newest individuals claim its college or university defrauded her or him as well as their applications for rest from the newest Service out-of Knowledge was put off for many years.